bear market - solar polar

Solar Cycles Predict the next Global Financial Meltdown

24th September 2018

There is a longstanding correlation between the cyclical activity of the sun and the ups and downs of global financial markets.

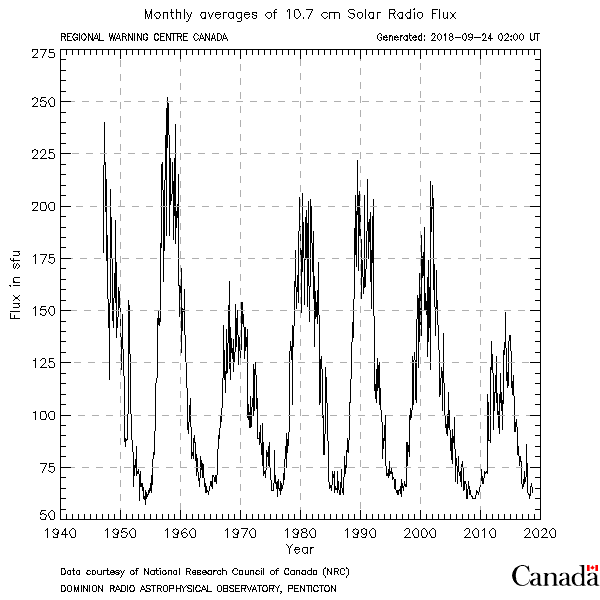

One way to assess the sun's activity is to look at the solar radio flux, a measure of the intensity of radio emissions from the sun at a wavelength of 10.7 cms. This varies in a cycle of approximately eleven years from peak to peak. The cycle is currently approaching a minimum. The solar radio flux is closely related to the sunspot number. At the moment, many days have no sunspots at all.

The F10.7 solar flux data are supplied as a service by the National Research Council of Canada.

https://www.spaceweather.gc.ca/solarflux/sx-en.php

2008 Global Financial Crisis

The solar minimum of 2008 correlates with the "Global Financial Crisis" that began on 15th September 2008. An enormous bubble of overvalued subprime mortgages had been growing for years. The trigger for the bursting of the bubble was the collapse of Lehman Brothers, the fourth largest investment bank in the USA. Shockwaves from the collapse of the bank had so many knock-on effects that many other banks worldwide almost went under. Within a few hours a massive financial hole had developed. Like the crumbling of the edges of a sinkhole, once the collapse had begun, nothing could stop it. To bring the carnage under control, governments pumped trillions of dollars of liquidity into the banking system. Ten years later, interest rates have not fully recovered and are still abnormally low.

1997 Asian Financial Crisis

The solar minimum of 1997 correlates with the "Asian Financial Crisis". Share markets in Thailand, Indonesia, South Korea and the Philippines crashed on 2nd July 1997. The bubble that had burst was the ballooning foreign debt of several Asian countries. The trigger event was a sharp decrease in the value of the Thai currency, the baht. Other currencies throughout Asia then plummeted, causing local share markets to crash and causing global share markets to decline over several months.

1987 Black Monday

The solar minimum of 1987 correlates with "Black Monday". This crash is known as "Black Tuesday" in Australia because of timezone differences. On 19th October 1987 the largest single-day share market fall in history occurred. Analysts disagree about the root cause of the crash and they also disagree about which event was the trigger. Share markets were a bit overheated. Iranian missile attacks on two American oil tankers seemed to cause a ripple of selling that soon turned into a tidal wave of mass panic selling throughout the world. The Dow fell 22% in one day. By the end of October 1987, Hong Kong markets had lost 45%, Australia had lost 41%, the United Kingdom had lost 26%, Canada had lost 22% and New Zealand had lost 60%.

Ms Scipio is an expert on political, economic, financial and taxation issues.

Ms Scipio says:-

AUD = Australian Dollar

EUR = Euro

GBP = Great Britain Pound

JPY = Japanese Yen

USD = United States Dollar

EUR = Euro

GBP = Great Britain Pound

JPY = Japanese Yen

USD = United States Dollar

The impact on Australia of the next global trainwreck will depend on whether the AUD collapses. A share market crash is one thing, but a currency crash is something else. The AUD could devalue sharply if a global crash causes a slump in demand for Australian exports of coal and iron ore.

Inflation surges when a currency collapses. Money saved in bank accounts loses its value. In extreme cases of hyperinflation, for example in Germany in the 1930s, cash becomes worthless.

To preserve wealth in a currency crash, tangible assets such as property and gold bullion are good things to have in a portfolio.

If a global share market crash causes a recession without affecting the local currency then property prices are likely to fall. If the currency is also devaluing then property prices could actually rise in monetary terms, even though property values might be falling in real terms.

In a currency crash, the value of savings can be protected by holding cash in a stable foreign currency, such as USD or JPY. But beware of relying on a single currency. If for example the next crash turns out to be centred on Japan then JPY would not be a good currency to be holding. A basket of currencies provides a safer hedge.

Taking any pair of currencies, for example AUD and USD, if there is any movement in the exchange rate then one currency of the pair must go up and the other currency of the pair must go down. This is true for all currency pairs.

Therefore in a financial crash, if a currency trader is holding the right currencies then wealth can not only be protected but big profits can also be made.

Of course, if a trader happens to be holding the wrong currencies then the result can easily be guessed.

Taking a look at what events might trigger a global crash tomorrow, two particular issues stand out.

Firstly, US/China trade hostilities threaten to drive the global economy into a recession. This could happen abruptly.

Secondly, Brexit might have all kinds of global repercussions. At the moment it is not even clear if there will be a negotiated exit.

Currency speculators sell GBP every time that Brexit negotiations have a hiccup. However, if there is a hard Brexit with the UK ending up with a completely free hand in the making of its future trade agreements, then GBP might become quite strong. If the European Union continues to fragment further after Brexit, or if some of the European states mismanage their economies again, then EUR could become a lame duck compared with GBP.

Brexit can be compared with the 16th century dissolution of the monasteries and the removal of the Church of England from Papal authority. Henry the Eighth's biggest divorce was the separation of England from the rest of Europe.

Apart from the US/China trade war and Brexit, there are various undercurrents that could lead to a crash.

Stability of markets is a key factor. At the moment, the volatility index is not particularly high despite USA/China trade tensions.

The risk of a major military conflict is another major factor. Major military conflicts continue to be avoided despite there always being serious international disputes.

There are a few bubbles. Increases in the amount of futures trading and currency trading could be considered as being a sort of bubble. High debt levels, particularly in Australia, can be considered to be a bubble.

Overall, it would be hard to say that a global financial meltdown is imminent. But then again, crashes can happen suddenly.

The Reserve Bank of Australia recently pronounced that trade tensions were posing a material risk to the Australian economy. Translated, this means that trade wars could induce a recession in Australia. No mention was made of any looming crash.

If you are a wealthy person who is worried that you might soon lose all of your money then my advice is to spend the lot now while you still have it. At least you will have some fun even if there is nothing left for your retirement.

Sergio Bello is an expert on science, technology and engineering issues.

Sergio Bello says:-

If financial crashes could really be predicted then they would not happen. If market participants think that a market is becoming overvalued then the players tend to sell and thus the overvalued market is pulled back down into line. Players do not sit and wait until everybody else is selling because by then it is too late to sell. This is one of the ways in which markets behave rationally. This moderating mechanism normally operates in markets all the time.

Economists argue that markets do not always behave rationally. Greed, optimism, incompetence and crookedness cause bubbles to occur. Bubbles eventually burst. If a financial bubble is big enough, then its implosion can have serious global effects.

In modern times, due to automated computer algorithm trading, sometimes a flash crash happens due to nothing more than the herd effect of computer program traders all doing the same thing at the same time. If the intrinsic values of shares and securities remain firm, even though their monetary value is falling, then an algorithm-generated mini-crash will sometimes reverse and be followed by a swift market rise back to the level before the fall began. However, if market confidence is damaged in the mini-crash then any recovery may not be comprehensive.

If a crash causes intrinsic values to collapse, or if a crash has been triggered by the bursting of a large bubble, then the crash cannot reverse its course.

A market crash usually begins with a trigger event that causes widespread repercussions. For example, even a relatively minor event might cause heavy selling that in turn results in margin calls that cause more selling that then sparks panic that results in a meltdown. Once human-generated mass panic selling has begun, it becomes an unstoppable rolling snowball, growing and causing catastrophic damage to market confidence, making it impossible for markets to recover quickly.

Some markets are local, some are global. There are innumerable markets throughout the world - commodity markets, share markets, currency markets, lending markets, property markets, manufactured goods markets, etc. Markets do not all go up and down in lockstep. Each individual market has a life of its own.

The perceived correlation between solar activity and financial markets is that some major global financial crashes have coincided with minimums of solar activity.

There is no scientific reason why there should be any kind of correlation between solar cycles and financial markets. Viewed scientifically, the observed correlation is empirical evidence that human economic activity may be influenced by the sun in some way that humans are not aware of. As this seems to be rather unlikely, scientists mostly think that the correlation is simply a coincidence and therefore the correlation will eventually disappear.

If the pattern holds good into the future then there will be another major global financial upset within the next year, possibly within the next six months. Such an outcome might justify an extension of the Gaia Hypothesis to include the sun.

If, instead, markets are still buoyant by the end of 2019 then the correlation between solar activity and financial markets will be considered to have ended.

update: 1st January 2020

As at 1st January 2020, the current solar minimum is still ongoing.

The current solar minimum has turned out to be exceptionally deep. In terms of sunspot activity, it is the deepest since 1913 when there were 311 spotless days. (A spotless day is a day with no sunspots.)

There were 281 spotless days in 2019. In comparison, during the last solar minimum, 2008 had 268 spotless days and 2009 had 260 spotless days.

At the other extreme of the solar activity cycle, there was a combined total of only three spotless days during five years of peak solar activity from 2011 to 2015.

The magnetic polarity of sunspots reverses at the end of each solar cycle. By measuring the magnetic polarity of sunspots, scientists can determine to which cycle a sunspot belongs. Sunspots from the old cycle normally overlap for several months with sunspots from the next cycle. In other words, when the first sunspots of a new solar cycle appear this does not mean that the old cycle has ended.

There has been a first glimpse of the new solar cycle. On 23rd and 24th December 2019, sunspots were observed with magnetic polarity opposite to the polarity of sunspots during the previous eleven years. These heralds of a new solar cycle soon faded away and currently the sun is spotless again.

The NOAA/NASA Solar Cycle Prediction Panel recently issued a new forecast. The current solar minimum is now expected to reach its deepest point in April 2020. This new forecast is not actually very precise because it has a margin of error of plus or minus six months, meaning that the deepest point of the current solar minimum might not occur until as late as October 2020.

It is still too early to write off the possibility of there being a correlation between the cyclical activity of the sun and global financial markets. If there is any correlation, then it now appears that the most likely time for a global financial crash would be around April 2020.

Meanwhile, the amount of cosmic ray radiation hitting the earth is close to a record high. This is because the sun's magnetic field weakens during a solar minimum, and the current minimum is unusually deep. The sun's weaker magnetic field allows more particles from deep space to penetrate the solar system.